oregon 529 tax deduction 2020 deadline

Oregon has an additional. Oregon 529 Tax Credit 2020 Oregon 529 Deduction Limit How to login easier.

Tax Benefits Oregon College Savings Plan

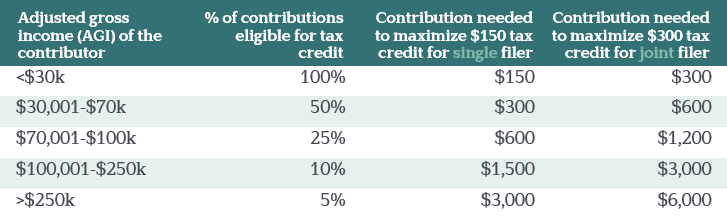

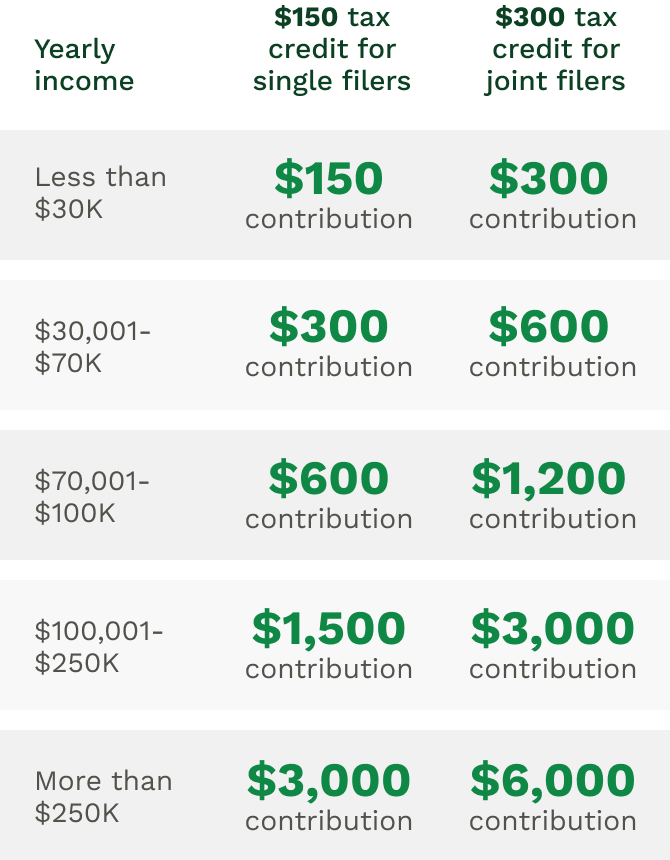

Starting with contributions made in tax years beginning on or after January 1 2020 a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an.

. Underpayment interest on. Most states have a December 31 contribution deadline to qualify for a 529 plan tax deduction but taxpayers in the states listed below have until April. Yearly tax returns are due April 18.

Let me give you a short tutorial. Oregon 529 Tax Credit 2020 will sometimes glitch and take you a long time to try different solutions. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program.

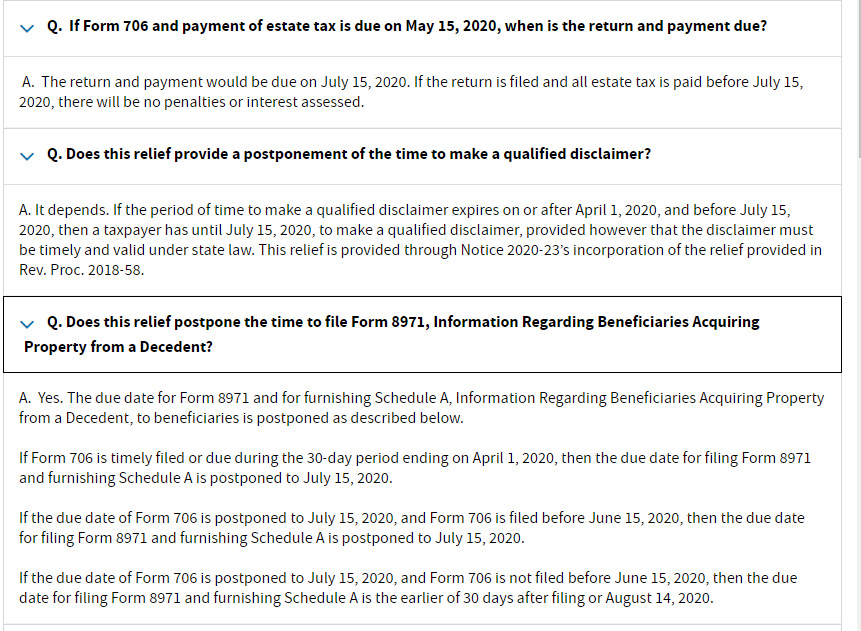

Press J to jump to the feed. April is usually taxation season although COVID-19 has actually pressed straight back the 2020 processing deadline to July. Explore the specifics Explore the specifics.

Individuals - Whats New. LoginAsk is here to help you access Oregon 529 Tax Credit 2020 quickly and handle. 2021 contributions to 529 college savings plans or ABLE accounts.

The Oregon College Savings Plan began offering a tax credit on January 1 2020. Federal deadline for payments and returns due after September 7 2020 extended to January 15 2021. Penalty and interest upon request.

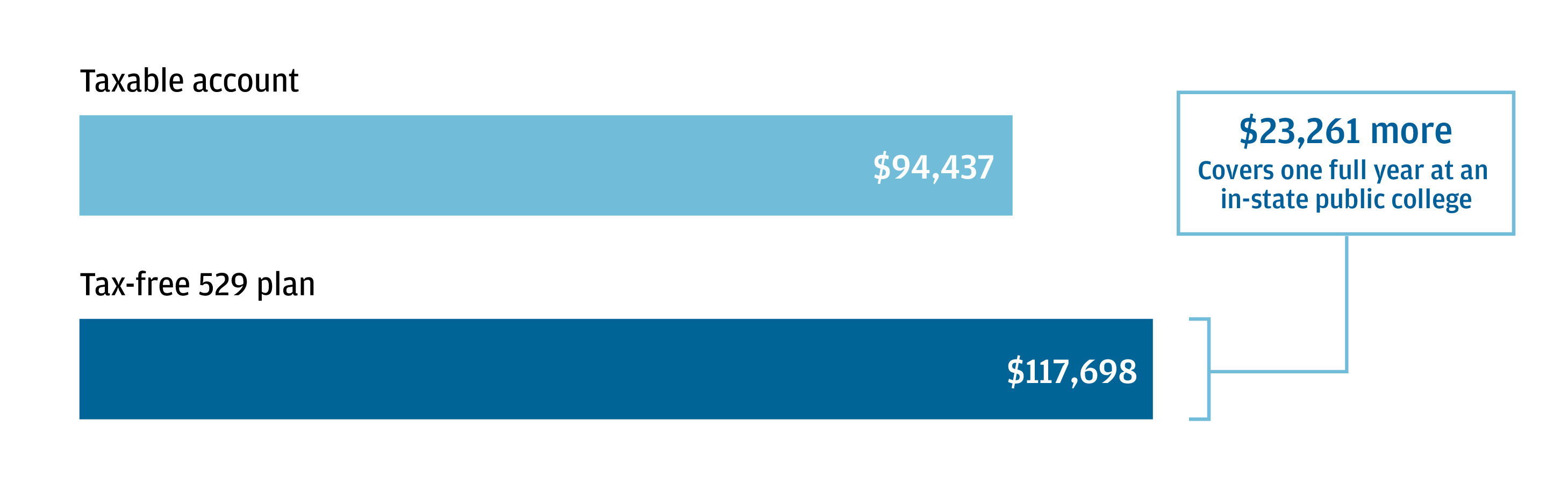

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. Parents and students invest in 529s and if the accounts increase in value they can withdraw that increase tax free to pay for college expenses. Individuals - Whats New.

Starting with contributions made in tax years beginning on or after January 1 2020 a tax credit based on your contributions to. Individuals - Whats New. At the end of 2019 I contributed 24325 to carry forward.

Credits for Oregon 529 College Savings Network and ABLE account contributionsStarting with contributions made in tax years. Credits for Oregon 529 College Savings Network and ABLE account contributions. While filing and paying taxes can be painful governments offer several.

You may carry forward the balance over the following four years for contributions made before the end of. Starting with contributions made in tax. June 15 2022 2022 second quarter individual estimated tax payments.

All contributions made prior to filing count toward your tax credit. Posted on November 13 2021 by clackamasor1. Contributions and rollover contributions up to 2435 for a single return and up to 4865 for a joint return are deductible in computing Oregon taxable.

Click on the states name to. Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan. LoginAsk is here to help you access Oregon 529 Plan Deduction 2020 quickly and.

Go to Oregon 529 Tax Deduction website using the. April is generally tax season although COVID-19 has pushed back the 2020 filing deadline to July. It may be limited further based on your adjusted gross income AGI.

September 15 2022 2022 third. Oregon College Savings Deduction 2020 Oregon 529 Tax Credit 2020 Oregon 529 Contribution 2020 How to login easier. Oregon 529 Plan Deduction 2020 will sometimes glitch and take you a long time to try different solutions.

The federal tax subtraction limit is 6950 3475 if married filing separately for 2020. Let me give you a short tutorial.

/ScreenShot2020-01-28at5.14.18PM-95d56fcae5014d0086b8b50d0f01c9ac.png)

Form 1099 Q Payments From Qualified Education Programs Definition

Hsa Contribution Income Limits For 2022 2023 Individual And Family

529 Plan Tax Benefits J P Morgan Asset Management

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tax Benefits Oregon College Savings Plan

The Most Important Thing To Do With Your 529 Before Year End

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It Oregonlive Com

529 Plan Advertisements And Marketing Collateral

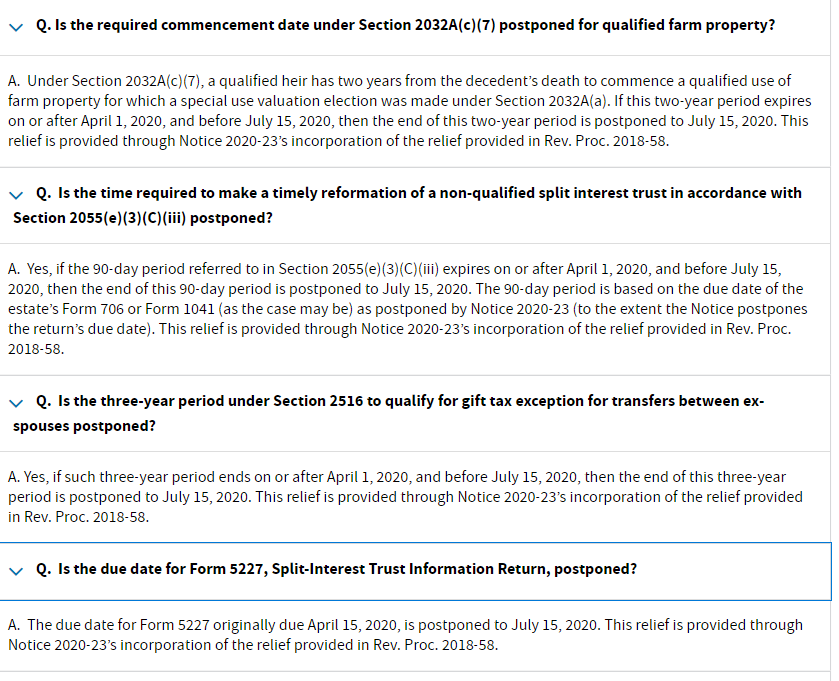

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

Serene Point Advisors Facebook

2018 Contribution Limits Increase For Utah Tax Credit Or Deduction

How To Use A 529 Plan For Private Elementary And High School

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

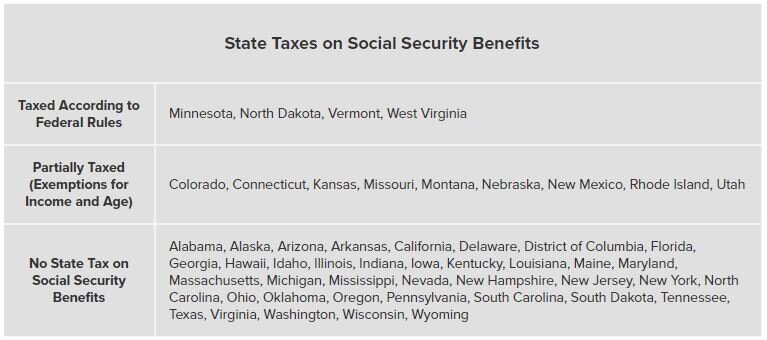

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times

Tax Benefits Oregon College Savings Plan

How To Use A 529 Plan For Private Elementary And High School